unemployment insurance tax refund

File a Report of Change. In the latest batch of refunds announced in November however.

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Submitting this form will.

. Generally for a refund to be approved the money that caused the credit must have been paid at least 21 days. Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts. For additional information pertaining to the electronic filing regulation and requirements contact the Employer account Service unit at 866 4299757.

Notice for Pandemic Unemployment Insurance Claimants. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Whatever your business employment needs this powerful online resource can help.

After registering with NMDWS you will. Use the Unemployment Tax and Wage System TWS to. Using Unemployment Tax Services.

Request a refund of the credit balance on our unemployment insurance tax account. Effective July 27th 2021 you will no longer be able to file a new PUA claim through this portal. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it.

Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. UI Tax Payment by ACH Debit. See How Long It Could Take Your 2021 State Tax Refund.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Use an existing User ID if you already have one for another TWC Internet system. Check For The Latest Updates And Resources Throughout The Tax Season.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. New employers subject to Unemployment Insurance taxes must register with NMDWS on to the Unemployment Insurance Tax Self-Service System. IR-2021-159 July 28 2021.

For some there will be no. Access HR and labor market information. File Wage Reports Pay Your Unemployment Taxes Online.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. The Internal Revenue Service has just sent out an estimated 430000 tax refunds to people who wrongly paid taxes on unemployment compensation for the tax year of 2020. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

File a Quarterly Wage Report. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010. Submit quarterly wage reports for up to 1000 employees using one of.

View Benefit Charge and Rate Notices. Ad Bark Does the Legwork to Find Texas Tax Return Experts. This taxable wage base is 62500 in 2022.

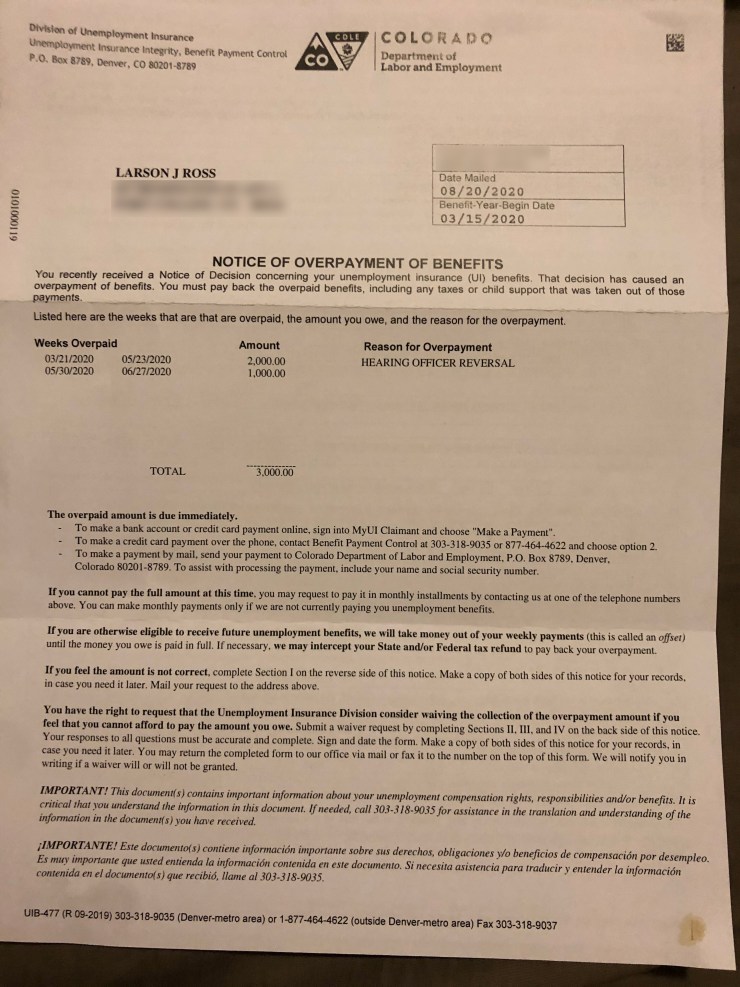

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Unemployment Refunds Moneyunder30

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Sending Out Another 1 5 Million Tax Refunds To People Who Overpaid On Unemployment Benefits Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Taxable Benefits Explained By A Canadian Tax Lawyer

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

The Irs Has Sent Nearly 58 Million Refunds Here S The Average Payment

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

1099 G Unemployment Compensation 1099g

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest